What you should know about an ICP audit.

Over the last couple of years the DCAA has increased it's focus on auditing Incurred Cost Proposals. This has resulted in some companies getting involved with the DCAA auditing ICP's as much as 6 or 7 years old. I don't know about you but I have a hard time remembering last week, let alone 6 years ago. This certainly causes a problem in contract close-outs since the ICP must be accepted in order to true up the indirect billing rates on a cost type contract. There are some new directives that may help relieve some of this situation for the small business.

The assistant director of policy & plans within the DCAA, Donald McKenzie, issued a memo on October 29, 2013 to help provide some new direction. In this memo there were 4 significant topics:

- Prior year questioned cost thresholds were changed

- Defined all ICP's with Auditable Dollar Volume (ADV) less than $5M as low risk if the previous audit found no significant questioned costs unless significant relevant risk exists

- Allowed auditors to use professional judgment to classify ICP audits between $5M & $250M ADV as low risk provided the last audit had no significant questioned costs

- Declared that there would be no sampling for low risk proposals with ADV less than $1M

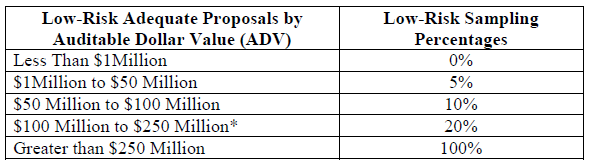

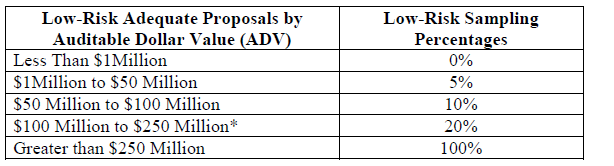

This is good news for the small business, especially those with ADV's less than $5M. Even those businesses with ADV between $5M and $250M have some reason for optimism as the sample basis for audit on these proposals is around 5%. The memo defines all sampling percentages as:

So, as you can see, these new policy directives have some potential benefit for small business, especially if they do things right and don't have issues with the ICP. This is why we believe it is critical to get professional help in preparing your Incurred Cost Proposal, so that you can ensure it will pass and lower your risk, if not eliminate it, on the next audit.

Now there could be other triggers that would put the proposal up for audit. These include things like excessive pass though charges or excessive executive compensation. There will always be "red flags" that would make an incurred cost proposal look like a higher risk and therefore auditable. Again, professional help can ensure that you don't venture into dangerous ground in this area and help keep your ICP in the "low risk" category.

The DCAA is making these changes to help mitigate the large backlog of audits while still providing protection to the taxpayer (the ultimate consumer here). The benefit of this to the small business is allowing the contracting officer to act swiftly in finalizing billing rates. This is a benefit to the small business.