NSF Phase II SBIR/STTR Financial & Accounting System Requirements

Small Businesses pursuing non-dilutive funding through the National Science Foundation's SBIR/STTR program must pass a financial review prior to receiving a Phase II award. This is known as a Financial Review and CAP review. There are also requirements placed on the Phase II awardee by the award document and many small businesses are unfamiliar with both the process and the requirements for accounting and financial systems during the performance of the award. I will try here to outline briefly (a 30,000 foot view) what is required by the NSF and why.

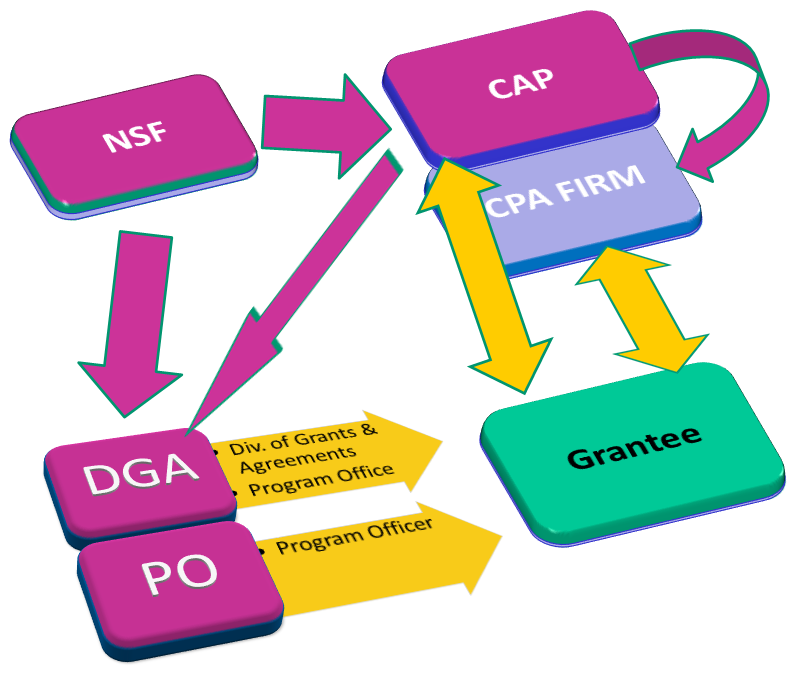

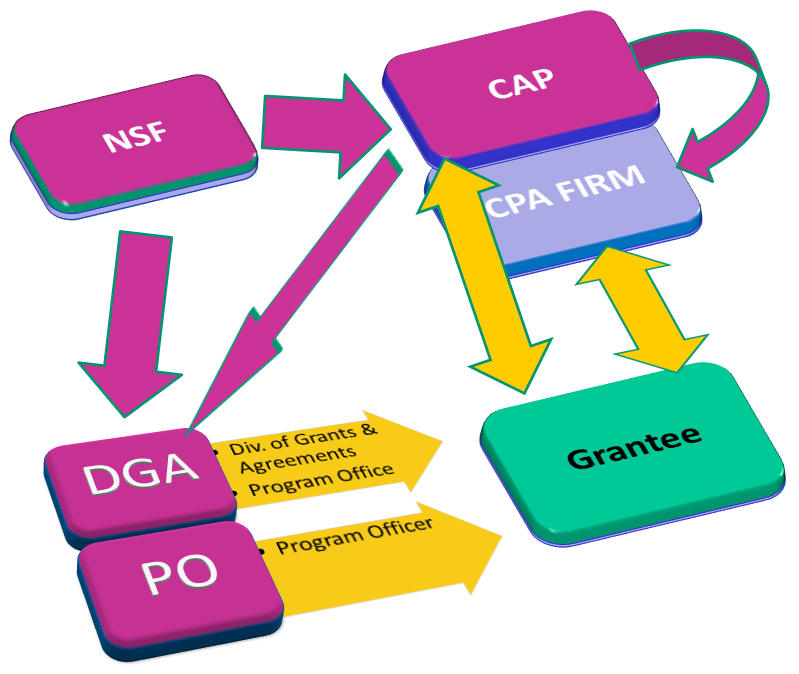

First of all, I think it is important to have an understanding of the different players in this process. I think a picture is worth a thousand words.

It is important to realize a couple of things here. First the Division of Grants and Agreements is what is called a Warranted Official and is the only group authorized to obligate Federal money. Second, the Cost Analysis and Pre-Award group (or CAP group) will review the proposed awardee's financial condition with the help of an independent CPA firm working with them. The CAP group will make recommendations to the DGA group as to whether or not an award should be made. The Program Officer is your friend and normally most familiar with your technology but they have no authority for funding or changing award documents.

When a company is selected for a CAP review, this is a good thing as the NSF has deemed your technical proposal worthy. The NSF then passes the decision on the award to the DGA who enlists the CAP group to help them decide on whether or not to issue an award. This CAP review will happen in a very compressed period of time and it behooves the Phase II company to be prepared in advance for this review. Once the company receives notice that they are in a CAP review, they only have 10 calendar days to submit a list of information to the CAP group. This information is mostly financial in nature and will allow the CAP group to determine if the company is a viable concern and will be able to stay in business to complete the Phase II effort. In short, it is best to prepare in advance for this review. It is worth noting here that the NSF encourages companies to get their accounting systems set-up during Phase I. It is now written in the NSF Phase I solicitation that the NSF will provide up to $10,000 in direct money during phase I for review by a CPA or other expert to set-up an accounting system adequate for tracking expenditures on a Government Award. An adequate system includes both a specific accounting system as well as a specific time tracking system. These requirements can be found in the terms and conditions for a Phase II award, section 12. Basically this means an accounting system meeting the requirements of FAR Part 31 which describes how to identify and track costs. In addition, the NSF required awardee's to track their time and they require that awardees do that in accordance with DCAA requirements. I think it is a really good idea to set this up and the company gets used to these requirements during Phase I.

In the Financial Review, the CAP group will look at the company's previous financial reports, look at previous tax returns, look at key financial ratios such as the Current Ratio, Quick Ratio and Asset to Debt Ratio. They will also want to look at backup data if the company has proposed using an indirect rate different than the 50% safe rate. Many companies use the "Safe Rate" but if you have a facility, or Fringe costs or other normal business overhead costs, you may be selling your NSF SBIR funding short by using the "Safe Rate". It is probably wise to have an expert (like ReliAscent) help you decide on whether or not it makes business sense to use the "Safe Rate" or to propose an indirect rate. The CAP group will also look at how the company recorded, tracked and monitored a budget during Phase I.

The CAP review will happen rapidly and it pays to be ready for this step as there will be a lot of questions for the company during this process. Questions will come from the CAP or the CPA assigned by the CAP group. As I mentioned before, the prospective awardee has 10 calendar days to prepare and submit all the data requested. You can see what data will be required at the CAP site. The CAP group will then take 5 working days to review and assign a CPA to help them. The CPA group has 10 to 15 days (depending on the indirect rate) to complete their review and ask questions. Then the CAP group has 8 days to submit a recommendation to the DGA. The DGA then will make a decision on whether or not to issue the award and either issue or reject. So you can see all of this will happen very fast and it is important to be prepared. It can be invaluable to have an expert help you put this in place ahead of time so that the process goes smoothly and you will receive the Phase II award. ReliAscent has been helping NSF SBIR/STTR awardees for over 30 years and has helped many companies pass the CAP review.