Indirect Rates FAQ

The Olympic Games (including this year’s summer games in Paris) provide the perfect analogy for anyone unfamiliar with indirect rates. While most of us are familiar with the game and rules surrounding basketball, few of us are familiar with team handball. Trying to apply what you know about basketball is futile when deducing any rules surrounding team handball, unless you already know those rules.

The same can be said for developing indirect rates. In a sense, you have to forget all you know about finance accounting or mathematics, except for that small sliver of knowledge having to do with ratios. And when applied to the concept of pricing and job cost accounting, it can be especially frustrating.

In that sense, ReliAscent is always happy to both educate, mentor, and tackle the toughest questions concerning indirect rates. What follows is just a sampling of the questions we are routinely asked:

What is the difference between direct costs and indirect costs?

In general, direct costs are costs directly related to the performance of a grant or contract. Indirect costs are not a result of a specific grant or contract, but rather in support of overall company operations.

When calculating a G&A (General and Administrative) or F&A (Facilities and Administrative) rate, what is the difference between a pool and a base?

First of all, G&A and F&A are essentially synonymous mathematically. A G&A rate is generally recognized by contracting agencies and F&A is the customary term used by grant agencies.

A pool is a collection of costs. In this context, an indirect pool is a collection of all indirect costs. The base is another collection of costs, in this case project costs, that have some causal relationship to the pool. In a single indirect rate system, the pool is the numerator and the base is the denominator. This ratio yields the indirect rate. You can then say for every dollar you spend on a project, you then “allocate” or “absorb” or “burden” that certain percentage more to the project.

Example 1

Project cost = $1

Indirect rate = 25%

Indirect costs allocated/absorbed/burden = $0.25

Total project cost = $1 + $0.25 = $1.25

Can fringe costs be considered project costs?

Yes, if you chose an indirect rate structure where fringe can be included as a project cost. This requires a bit more math to derive a separate fringe rate from the overall G&A rate.

When calculating a fringe rate, what is the pool and what is the base?

The pool consists of allowable fringe benefits, such as employer-paid payroll taxes, paid time-off, insurance premium subsidies, retirement fund contributions, and the like. Typically, the base is all productive, “at-work” labor dollars

What’s the typical indirect rate structure for a small firm just starting out?

A single G&A rate system is suitable, where indirect costs are applied to all project costs. You may wish to also consider a modified G&A base, and a separate fringe rate.

What do you mean by a modified G&A base?

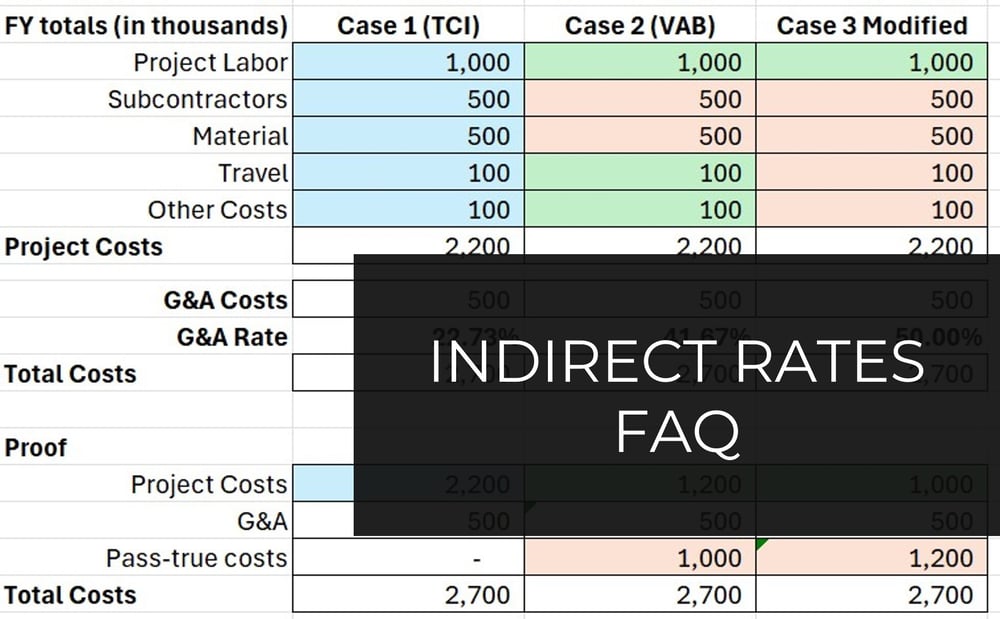

The typical G&A base, or denominator, includes all direct or project costs. This is called the Total Cost Input, or TCI base. The G&A can also be calculated using a Value-Added Base (VAB), where costs such as subawards and materials are excluded from the G&A base. Another example of a modified base is where G&A is only applied to project labor.

Example 2

What are the typical or appropriate indirect rate levels for small firms?

Indirect rate development is a process unique to each small business. The overall goal is to provide an indirect rate that provides for common and allowable business costs over the life of your productive grants and contracts. Other factors to consider are agency limitations, your competitive environment, and the extent to which you outsource project costs.

Can I switch indirect rate structures?

Unless you have legitimate reasons to do so, it’s not advised to change to a different indirect rate structure. Legitimate reasons would include company growth and financial competitiveness. In any case, you should always alert your government grant or contract manager to a change, assuring them that final projected grant or contract costs will not be negatively affected.

What agencies have a “safe rate”?

Some grant agencies have a “safe rate” whereby an arbitrary indirect rate percentage limit is expressed. Indirect rates above the limit require agency review, whereas indirect rates falling below the limit do not get scrutinized. In the DoD case, all applicants are required to state a unique indirect rate. In contrast, the Department of Energy requires indirect rate justification if the budgeted fringe costs plus indirect costs are higher than 50% of the budgeted labor.

What are “Capped” Rates?

Grant agencies, such as NIH and NSF for the SBIR programs, caps indirect rates at certain levels. NIH caps the F&A rate for Phase I SBIR’s at 40%. It should be noted there’s no stated cap on a fringe rate, so a two-tier indirect rate structure provides a firm a better opportunity to have a financially healthy F&A rate.

The DoD has been known to cap rates on cost-plus type contracts, but only when contracting officers have low confidence contractors can appropriately calculate and manage their rates.

Budget requirements for any funding opportunity should be studied to find these types of limitations on indirect rates.

How do I develop an Indirect Rate Model?

Very carefully. If new to the concept, it’s best to consult a firm knowledgeable on this subject.

Some agencies provide their own indirect rate models, which at times can be mathematically problematic. In this case, it’s best you have your own pricing model, including indirect rates, that you can compare results against the agency model.

The indirect rate model you choose depends on the indirect rate structure you’d like for your business. In general, unless you have multiple projects and over 10 or so employees, you can probably use either a single indirect rate model, a fringe as direct plus G&A, or a classic DoD Two-rate model.

What if I already have indirect rates established with another agency?

Government agencies will generally accept these indirect rate calculations, but they may still be reviewed for accuracy. Also, at least one agency (DOE’s ARPA-E) disallows Independent Research and Development (IR&D) costs.

I only have one government sponsored job and no other revenue. Why do I have to jump through these hoops to calculate an indirect rate? Aren’t all costs considered “direct”?

A single contract or grant as the sole source of income is the exception, not the rule. Government cost principles assume you are or will soon be a successful partner in bringing forth technological solutions resulting in many such contracts or grants operating concurrently. When you have multiple projects, indirect costs are “allocated” to each project by applying the indirect rates to each of the project costs.

Can I propose no indirect rate(s) or propose a de minimus 10% G&A?

You can, but that won’t make your financials very happy. Remember, the government will reimburse you for allowable fringe and administrative costs through your indirect rate(s). For example, for C-corporations and some LLCs, employers must pay roughly 7.65% of employee gross wages in payroll taxes. A de minimis rate or no indirect rate puts the small business at a cashflow disadvantage. We believe a rate of 25% is the absolute minimum for a small business just starting out.

What, then, would be the maximum indirect rate the government can tolerate?

Again, that depends on many factors related to the small business. Mature businesses may have a large lab with associated indirect costs that places a high burden on project budgets. Pre-revenue, equity-funded firms may have astronomical indirect rates, so they may have to offer the government a discounted rate. One benchmark where the government might apply some scrutiny to indirect rates is if budgeted indirect costs exceed project costs. They may ask what value the government derives when one dollar of project cost is burdened with one dollar or more of indirect costs.

What data is required to complete an indirect rate model?

That depends. If you have reliable accounting data from a prior year, this can be used to justify indirect rates. You may also develop a budget for the coming year using projections for your project and indirect expenses.

Hopefully this gives you a taste of some of the rules surrounding the development of indirect rates. Be sure to keep those great questions coming, and don't forget to download your copy of ReliAscent's Guide to G&A Rates for more helpful tips (ReliAscent also offers indirect rates and provisional billing rates consulting services for government contractors and companies submitting SBIR and other proposals--contact us today to learn more).

...Now where did I put those rules for team handball?