Is QuickBooks DCAA Compliant? QuickBooks and DCAA Compliance Requirements

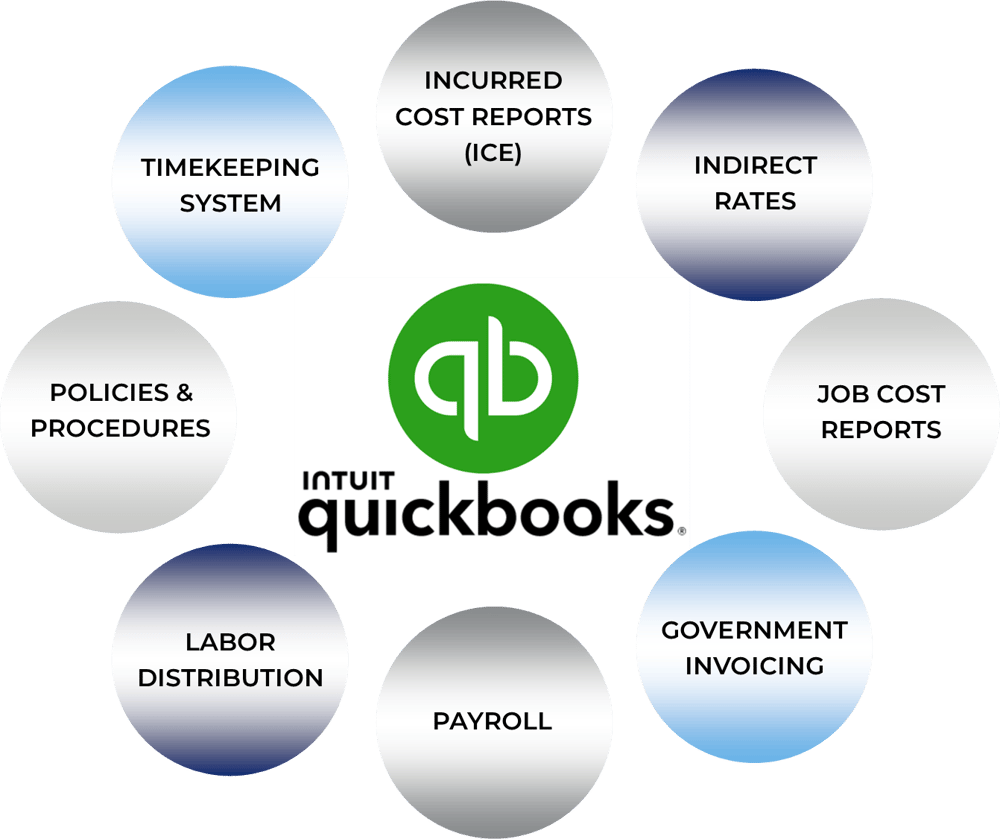

Many start-up businesses and small businesses are in need of a DCAA compliant accounting system but cannot afford many of the options for software that is DCAA compliant “out of the box”. These “out of the box” solutions usually include systems like Deltek CostPoint®, Deltek First Essentials®, Sage Mass 90®, Jamis Prime®, Microsoft NAV® as modified by PVBS, Procas® and ERP-Gov® to mention a few. A small business wants a system that is not too complicated for their simple structure and yet can be affordable for their limited budget and still have the capability of passing a DCAA audit. The good news is, “Yes” a system based on software like QuickBooks® can be made compliant. Normally a QuickBooks® system cannot be compliant without the addition of what I call satellite systems. The following graphic illustrates this concept:

This diagram was constructed around the desktop version of QuickBooks® as the “general ledger” system. It assumes that the general ledger system can be set-up in a job cost type environment (which QuickBooks® desktop can). If further assumes that the general ledger can be constructed in a manner that will allow for labor time to be converted to dollars and posted to the general ledger for invoicing (in the case of direct labor) or posted to indirect expense accounts so it can appropriately be used to calculate indirect billing rates. This is commonly referred to a labor distribution system. This can be done within QuickBooks® desktop but is not so easy with the QuickBooks Online® version. Other accounting systems like Sage 50® can be set-up in a similar fashion to the QuickBooks® desktop version. The other critical function for set-up in the general ledger is the complete and distinct separation of direct and indirect expense accounts. There should also be a method for identifying and segregating unallowable expenses. All of this set-up is possible in the QuickBooks® format (as well as some other formats such as Sage 50®). Once the general ledger is set-up in this fashion, it will be necessary to construct the satellites. Each of these systems will be external to the general ledger system and therefore an effective system must be constructed to exchange data from the general ledger system. Data must also be reconciled between each satellite and the general ledger.

Hundreds, if not thousands, of systems have been constructed in this fashion and also passed DCAA audits. ReliAscent has constructed hundreds of systems in this manner, and passed DCAA audits with them all. So it can be done and we actually encourage it for small business as this is usually the most affordable way to construct a DCAA compliant accounting system.

If you would like to learn more about how ReliAscent's experts can install a DCAA Compliant QuickBooks Accounting System (or convert your existing QuickBooks system to meet DCAA requirements), contact us today!

ReliAscent also provides Free QuickBooks DCAA Compliance Reviews for contractors. To request your free review, contact us.