Preparing a Government Contract Cost Proposal

In the world of government contracting, the pricing of a proposal can be the section of the proposal taken too lightly by many bidders. Here at ReliAscent, one of the most difficult things to see is a client “win” a proposal (Grant or Contract), that has several “losing” features built into the cost & pricing section. At ReliAscent, our passion is helping companies that have exciting technologies or services succeed. We can relieve the pressure of government regulations so the company can concentrate on their core expertise, providing the best chance for success.

Unfortunately, the act of preparing a cost proposal is often considered child’s play, given the complexity of the actual contract/grant work. Putting costs together including estimates of time, materials, equipment, travel, and other direct costs should be fairly easy for someone who is preparing a technical solution to a unique problem, right? So why do we find so many mistakes? First of all, rules on cost proposals for the government aren’t intuitive. They introduce the concept of indirect rates, pools, bases and allocations of intermediate rates. Now, the concept of addition and subtraction introduced by the Greeks isn’t even in Greek anymore; it is a language of bureaucrats (possibly the worst language ever created)!

Each agency has a different format for their cost proposals. In this modern world of on-line submissions, most of them have a pre-canned form that is on their submission site that you must fill out. Regardless of the submission requirements, every cost proposal has the same basic elements:

- Direct Costs (Labor, Materials, subs, consultants, travel, etc.)

- Indirect Costs (Fringe, Facilities, Overhead, General & Administrative, etc.)

- Fee (another word for profit)

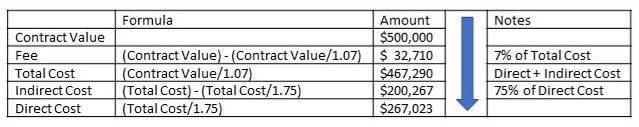

In a Grant or Contract, the government is asking you to provide them with as much ‘product’ as they can get within a specific ceiling price. Because of that, you must develop your costs BACKWARDS. You should have a good idea of what price (the ceiling) that the government is willing to pay. In many programs the ceiling is published and known to all participants. When preparing a cost proposal, you take the ceiling amount, back out the fee, back out your indirect rate(s), the result is the target that you can spend on direct costs. See the following example, using a $500,000 contract, 7% fee and 75% indirect rate:

In this example, your target for direct costs would be $267,022.70. With the indirect rate and fee set you may spend up to that amount on ALL direct costs. Once you have performed this calculation, then you have a budget on all your costs. Now you can start to determine just how much you can provide to the government with the funds available. The indirect costs, thru the indirect billing rates, are a way for the government to help you sustain your company to succeed by covering their share of the overhead costs of the business.

So, let’s discuss some of the basic mistakes that we see during proposal evaluation:

- Not calculating your costs backwards:

- Determine your direct costs first and take whatever is left as your indirect:

- Generally, these awards have fixed ceiling amounts. So, if you are bidding on a $500k project, you add up what you want to do and determine that it will cost $375k direct. Then you put $125k for indirect, to get the ceiling amount of $500K, and submit your proposal. $125k may seem like a lot of money, but if you run it thru the example above you will see that you WILL ACTUALLY LOSE MONEY in this scenario!! Even if your indirect rates are as low as 40%, in the example above you would still lose money.

- Determine your direct costs first and take whatever is left as your indirect:

-

- Reduce your fee to “Make the Numbers Work”:

- The definition of a business is ‘an entity providing goods or services with mutual benefit”. It is not mutually beneficial if you aren’t making any money. In the example above, you could reduce your FEE TO ZERO and still LOSE MONEY if you plan too much direct work. The government also defines a list of unallowable expenses that will also reduce the amount of cost recovery and, if you reduce your fee to zero, you will lose money.

- The definition of a business is ‘an entity providing goods or services with mutual benefit”. It is not mutually beneficial if you aren’t making any money. In the example above, you could reduce your FEE TO ZERO and still LOSE MONEY if you plan too much direct work. The government also defines a list of unallowable expenses that will also reduce the amount of cost recovery and, if you reduce your fee to zero, you will lose money.

- Reduce your fee to “Make the Numbers Work”:

- Reporting or budgeting hours incorrectly:

- Budgeting 100% of anyone’s time against the project:

- This is not possible in the eyes of the government. A 100%-time budget means that you don’t have vacation, holidays, sick, training, etc. This is an indication of a violation of the Fair Labor Act. Claiming 100% of someone’s time is saying that 2,080 hours per year will be used and charged to the government as direct labor. If you intend someone to spend all their time direct, that’s fine, but reduce the hours by normal business activities and anticipated time off. Generally, a number around 1,800 to 1,900 is more appropriate for a full-time project employee, and this number only takes into account vacations and holidays. If the employee also participates in other company activities such as training, answering questions for other workers, company meetings, emails not related to the project, the number would naturally be lower. A DCAA auditor will always come from this point of view and seeing more than about 1,900 hours will definitely raise a flag to the auditor.

- Reducing your projected direct hours, even though you plan to work more to achieve the proposed objective. Planning to work unreported/unrecorded hours in the process of bidding a proposal is a violation of the FAR. It can also be deemed fraudulent. If it can be proven that you have done this, you could get into serious ‘hot water’ with the government. The government expects to pay a fair wage for a reasonable work effort.

- Budgeting 100% of anyone’s time against the project:

-

- Plan to work “after-hours” to get the admin work done, so you can work during the day to support the technology.

- Unfortunately, we see this as a methodology in many small businesses. It is not only frowned upon when working with the government, it is ILLEGAL. Once you are under contract with the government you are required to account for every hour that you spend in the business (direct or indirect). This in the only way the government can assure that they are paying their fair share and only their fair share of your indirect costs. If you are working 12 hours a day, 8 on the project and 4 on other administrative duties, but only tracking the 8 on the project you are defrauding the government by under reporting labor.

- Plan to work “after-hours” to get the admin work done, so you can work during the day to support the technology.

-

- Defer your wages:

- This is possible, however, it can lead to real trouble. Before deferring wages, please consult a government accounting professional about the implications. Any deferred compensation must create an expectation to be paid out at some reasonable time and in some reasonable and agreeable form. An auditor will want some assurance that this will happen. Done incorrectly this can lead to charges of fraud, owing the government money and even being debarred from future government work. There are also IRS implications that need to be discussed with your tax accountant.

- Defer your wages:

- Not doing the math correctly on your indirect rate(s):

- “Safe” Rates, de minimus rates, or unjustified rates:

- Some agencies allow you to take a specified “safe” rate without any justification or backup calculations. This may be necessary if you have no clue what your indirect rates are going to be and this is your first Grant or Contract. If you have any indirect costs (such as employee insurance benefits, facilities, etc), taking one of these rates can be a significant financial mistake.

- Calculate your rate, if you find that your rate is lower than the “Safe” rate, then use the higher rate. Over 85% of our clients have rates that are higher than the ones offered by the agencies that require no justification. Justification is actually rather simple, it just requires a documented basis of estimate, so don’t sell yourself short.

- Pick an indirect rate structure that makes sense for your business.

- You may think that because an agency seems to mandate a particular rate structure that you must pick that rate structure. That is incorrect. The FAR allows for you to select the rate that best suits your business model. With an agency like NSF, you may have to change your representation to appease the agency because they like the single rate structure, but this can be a simple spreadsheet manipulation from almost any rate structure.

- “Safe” Rates, de minimus rates, or unjustified rates:

- Lack of justification for ALL costs.

- When you read the agency guidance, you may find something that states you need to provide justification for “equipment over $5,000”. That is a specific requirement for additional justification for that type of item. Do not make the mistake and interpret that this statement implies that other costs under $5,000 don’t need justification. You MUST justify every cost on your proposal…EVERY COST! Do not provide any costs that are perfectly round numbers either (e.g. $10,000 for materials), unless all the justification added up just happens to come to that number (which is highly unlikely). Big round numbers are ‘red flags’ to dig into your justifications and potentially disallow costs.

- Adding Indirect Costs into your direct cost budget.

- Typically, when you are a start-up, you need lots of ‘things’ to conduct business. Things like computers, desks, chairs, tables, monitors, etc. Do NOT include these costs as direct costs in your proposal as these items will definitely benefit more than just that contract. These are all indirect costs and need to be included in your rate structure. You can get paid for all or most of them--provided you calculate your rate structure correctly. If you don’t do the rates correctly, then these items may come out of your pocket.

There are certainly more pitfalls than can be described here, but the idea is that writing a proposal is more involved than just throwing some numbers at the page. It seems easy, because in most cases the government tells you how much they are willing to pay. You need the money to advance your business in its research projects, so let’s go get it. But if you do it wrong, you may not be in business long enough to reap the benefits of the advanced research.

No one can determine what goes into direct costs better than the writer(s) of the proposal. You must ensure that you have collected the appropriate back-up to support your proposed direct costs. For example, you know that you are going to travel twice to the government site, once for a site survey and once for installation. In your travel “back up” you will need; sourced ticket prices from the airline or a site like Orbitz, sourced rental car pricing, mileage to and from airport, parking, baggage costs, hotel costs, including taxes and other fees, meals or the government approved “per diem” rates. Also, remember that you aren’t allowed to exceed the GSA Lodging and Per Diem rates.

Indirect Costs are a completely different animal. In order to figure out your indirect costs you must first know these things:

- Are the costs reasonable?

- What are my non-project costs (or costs that will benefit more than just this contract/grant)?

- In what manner does the agency that I’m contracting with want me to arrange or “pool” them?

- How are common costs allocated?

- What indirect rate structure works best for my company?

- Are the costs deemed allowable by the agency?

It is imperative that you get your indirect rates correct. With that said, let’s talk a little about the agencies that offer ‘Safe Rates’. In many cases, these Safe Rates are a bad deal. Before you take the Safe Rate, please do the math. Most companies find that they are well beyond the safe rate. Once you submit your proposal stating you are using the Safe Rate, you are stuck with that rate through the entire contract, regardless if you can prove you are losing money. These agencies push the Safe Rate stating that it is easier, and they are right, it is easier. It is also a better than 50% chance that you will lose money if you take it.

If this seems a little confusing, it's because it can be. At ReliAscent, we have personnel that have spent either their entire career or large portions of it learning to navigate these regulations. If you feel lost, please don’t hesitate to contact us.