Small Business Finance and Government Contracts

I have had several discussions recently with small businesses that are concerned with finding ways to fund their small business. Anyone that has started a business knows that certainly is one of the major concerns with starting a new business. But to someone new to this field, it can be a very frustrating exercise. Many people assume that the funding has to come from an independently wealthy founder. While this is certainly a way that some companies are founded but by no means is this the only way. This is part of what is affectionately known as one of the 4 F's for financing an early stage business (Founder, Friends, Family and Fools). Countless businesses are started with one or more of the 4 F's. Most of the time, this type of funding is only sufficient to get the firm started or only take the firm to a certain size. Relying on this type of financing will almost certainly limit the ultimate size of the organization.

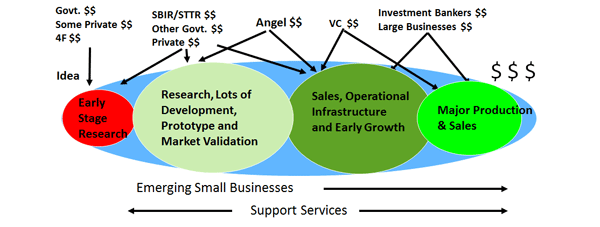

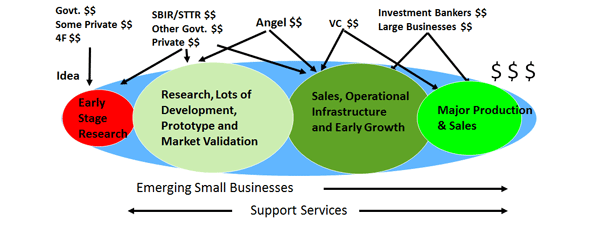

When a company is focusing on a product, the next stage of financing can be problematic. There are options available for financing including Venture Capital, Bank loans, Angel investors and Private Equity. While most people have heard of these forms of financing, they may not be available to early stage development companies, too much risk. There can be other pros and cons with each of these types of financing that must be effectively evaluated by the small business before jumping into the financing. Factors such as control of the company, cost of funds and ability to pay back must be looked at carefully. I like to use the following diagram for a "rough rule of thumb" for when to look for certain types of financing.

There are also other types of financing that have their application as well such as Receivables Factoring, Venture Leasing, Crowdfunding and even Joint Ventures. There are even SBA Loans, Hedge Funds as well as Public and Private Equity options. Again, each of these options has a specific cost, potential control issue and payback implications that must be addressed before moving. An often overlooked, and very viable to the start-up company, source of funding is the government's SBIR/STTR program. Many of the ReliAscent clients may be aware of this non-dilutive type of financing but I suspect there are a lot of small, start-up businesses out there that overlook this as a financing source. Again, please look at the diagram to see where this best fits in the product &/or company lifcecycle.

In conclusion, my point here is that there are many ways to obtain funding for a business. It becomes a very strategic decision for the business on how to best use these and plan for the future. Professional CFO help is the best way to do this to ensure the type of company that you, as a founder, would like to achieve. ReliAscent offers expert CFO services in this regard.