A visitor to our website posted an interesting question this morning on one of our "Ask A Question" / "Can't Find What You're Looking For?" forms (found throughout our website), and we wanted to share it...

Tyler Link on

A visitor to our website posted an interesting question this morning on one of our "Ask A Question" / "Can't Find What You're Looking For?" forms (found throughout our website), and we wanted to share it...

Tyler Link on

We would like to remind all Federal Government Contractors that if you had a cost reimbursable type contract in 2015, and your FY ends on December 31st, you are facing a critical deadline in less than 4...

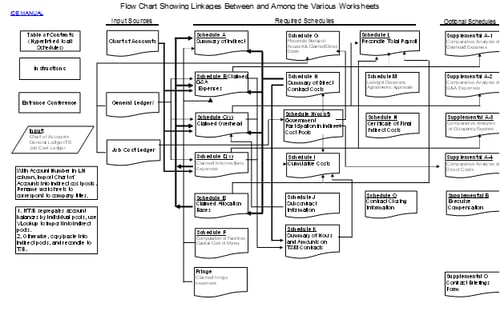

The Defense Contract Audit Agency (DCAA) has just released an updated version of the Incurred Cost Electronically Model (the standard ICE submission) for contractors preparing adequate incurred cost...

There has been a trend in the last 5 years that the DCAA is auditing fewer of the annual Incurred Cost Proposals (ICP's). This is based on the shear backlog as well as the risk factor to the government....

At this time every year I start to think about Incurred Cost Reports. Just like I start to think about my personal income taxes at home right after the holidays. Most companies will have until the end of...

Now that we are reaching the end of the "incurred cost proposal" season for most contractors (contractors whose fiscal year ends December 31st), most accountants are breathing a sigh of relief. This is...

The Federal Acquisition Regulations (FAR Para 52.216-7) require that the Federal Contractor submit an "adequate final indirect cost rate proposal" to their Contracting Officer within 6 months of the end...