It’s that time of year again (I know, I know), and even though your small business is just getting over the chaos of tax season, ReliAscent would like to remind our clients and all federal contractors...

It’s that time of year again (I know, I know), and even though your small business is just getting over the chaos of tax season, ReliAscent would like to remind our clients and all federal contractors...

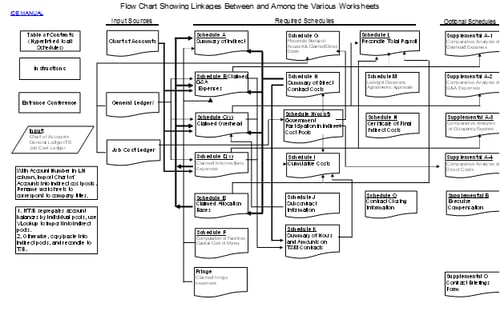

At this time every year I start to think about Incurred Cost Reports. Just like I start to think about my personal income taxes at home right after the holidays. Most companies will have until the end of...

If you haven't been monitoring your actual indirect costs thru the year, it is not too late to analyze and make an effort to control this before the end of the year. Why is this important? If you have a...