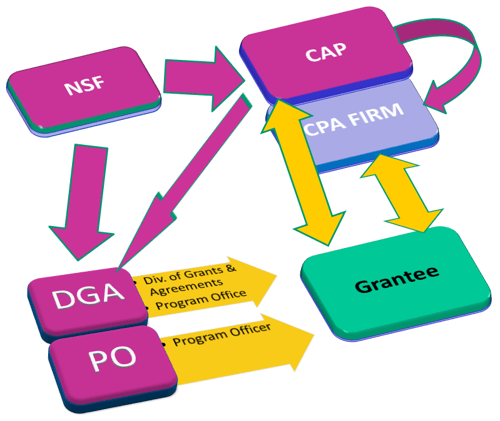

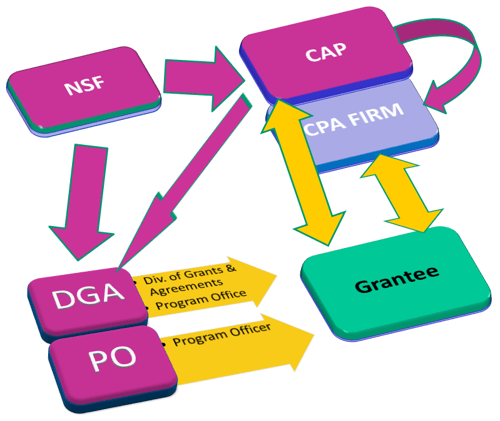

Small Businesses pursuing non-dilutive funding through the National Science Foundation's SBIR/STTR program must pass a financial review prior to receiving a Phase II award. This is known as a Financial...

Small Businesses pursuing non-dilutive funding through the National Science Foundation's SBIR/STTR program must pass a financial review prior to receiving a Phase II award. This is known as a Financial...

Many new/start-up small business federal contractors often ask the question: Will not having an approved accounting system disqualify our firm from bid opportunities?

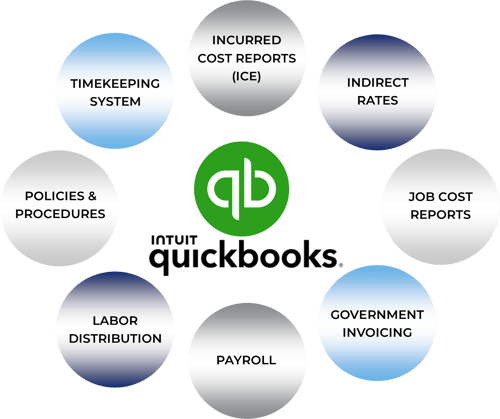

Many start-up businesses and small businesses are in need of a DCAA compliant accounting system but cannot afford many of the options for software that is DCAA compliant “out of the box”. These “out of...

If you are a small business, working with funds from awards from the Federal Government and you don't know if your accounting system is compliant with government regulations such as the FAR, you should...