Government Contract Types & the Risk Continuum

You maybe surprised to learn that the government attempts to us many of the same practices commercial firms use to buy products and services. In fact, you could say the majority of what the government purchases falls into this category. For the most part, the government purchases what it needs on a competitive, best-value, fixed-price basis. That’s no different than most commercially businesses, and it’s even how consumers chose the majority of their purchases.

However, Uncle Sam indeed has deep pockets and is able to fund projects on a large scope and incurs risks rarely found in the commercial world. We’re talking things like building stealth aircraft and sending people into space.

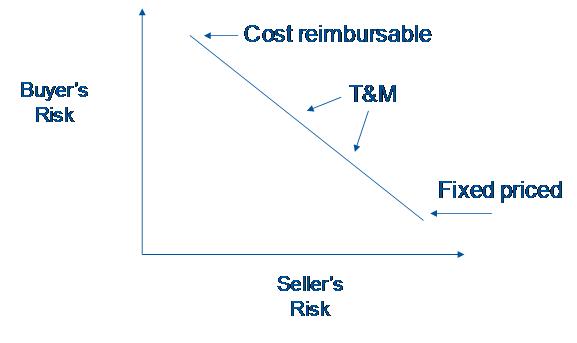

That’s why it’s useful to understand the Risk Continuum as it relates to buyers and sellers and how that translates into government contracting.

The price of a product or service has a direct relation to the amount of risk involved in producing that product or service. Routine, customary products in a highly competitive environment typically have most of the risk driven out, so costs and prices are competitive and predictable. Think most consumer-focused products and services.

More speculative projects may need a different contracting approach, given that the risks of production may need to be shared between the buyer and the seller. A good example of this in government contracting is the Time & Material contract, where the contractor assumes the risk by agreeing to fixed labor rates, and the government controls the total contract cost by ordering and monitoring hours ordered from the contractor.

The graph below depicts this relationship. The graph also shows how the buyer takes on more risks as the contract type moves into the realm of cost-reimbursement. This is where the seller’s scope of work is relatively speculative or is performed on a “best effort” basis. The upside for the seller is there is little or no financial risk. On the downside, the buyer will want to discount any fee, offer no fee payments at all, or ask the seller to contribute to the cost of the project (cost share).

The graph also shows how the buyer takes on more risks as the contract type moves into the realm of cost-reimbursement. This is where the seller’s scope of work is relatively speculative or is performed on a “best effort” basis. The upside for the seller is there is little or no financial risk. On the downside, the buyer will want to discount any fee, offer no fee payments at all, or ask the seller to contribute to the cost of the project (cost share).

In the case that the buyer is the government or a prime contractor on a cost-plus contract, the government/prime mitigates its cost risk by imposing a number of conditions on the contractor. That’s why the government requires an “approved accounting system”, establishment of approved indirect rates, and audits contractor actual financial performance on every cost-plus contract.

Understanding this relationship of risk to cost is critical first during the solicitation and proposal phase of a contract, and follows through to negotiations and contract performance.