I have had quite a few questions recently on Technical and Business Assistance (TABA) funds related to what they are, why they might be used for and who can apply for them. First of all TABA stands for...

I have had quite a few questions recently on Technical and Business Assistance (TABA) funds related to what they are, why they might be used for and who can apply for them. First of all TABA stands for...

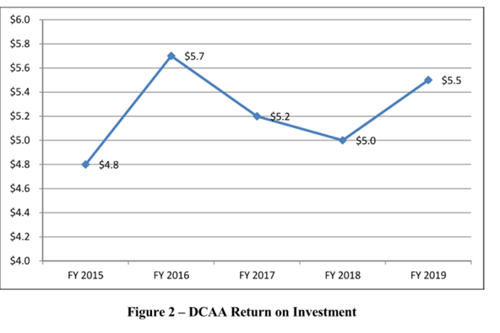

In a previous blog we examined, from a very top level, what it means when someone says they have had a DCAA audit. In that blog we explored the 4 major groups that the DCAA classifies audits, the number...

Many times when I talk with prospective clients I ask them if they have a DCAA compliant accounting system. Many times they say "I have a compliant accounting system because I've had a DCAA audit". Well,...

Recently there has been a trend in the business world to outsource certain business functions in order to make a more efficient operation and/or save cost of operation. In years past there was little...

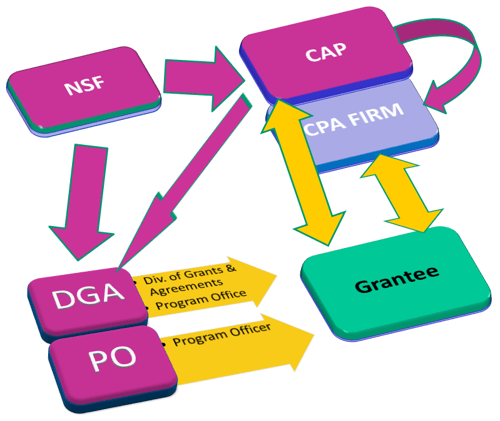

Small Businesses pursuing non-dilutive funding through the National Science Foundation's SBIR/STTR program must pass a financial review prior to receiving a Phase II award. This is known as a Financial...

There are several things to consider when a small business contemplates outsourcing its government contract accounting work. One consideration is the cost and experience of the people to do the work....

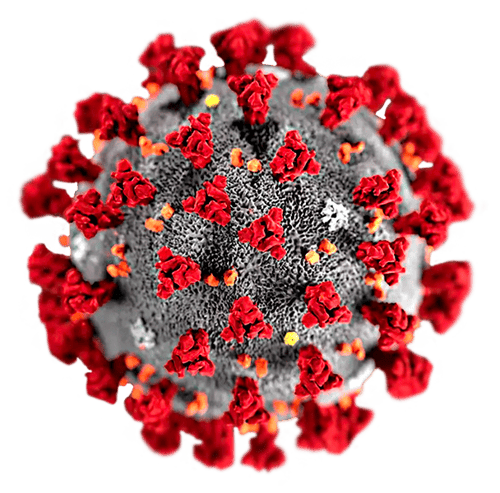

As we have all seen from the happenings of this strange year in 2020, there are a number of negative effects of the COVID-19 Pandemic. Hundreds of thousands of people have lost their lives, and millions...

There have been some shifts in policy at the Defense Contract Audit Agency (DCAA) over the last couple of years that are starting to be evident to the outside world. The FY 2018 National Defense...