Small businesses are the cornerstone of innovation in the US Government, and Federal Acquisition Regulation (FAR) Part 19 discusses Small Business Programs. It sets the size standards to be considered a...

Small businesses are the cornerstone of innovation in the US Government, and Federal Acquisition Regulation (FAR) Part 19 discusses Small Business Programs. It sets the size standards to be considered a...

The Small Business Administration (SBA) keeps statistics on small businesses in the United States. Recent data from the first quarter of 2014 show positive results for small business growth after a...

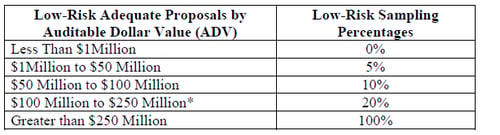

Over the last couple of years the DCAA has increased it's focus on auditing Incurred Cost Proposals. This has resulted in some companies getting involved with the DCAA auditing ICP's as much as 6 or 7...

As we did a webinar this morning for quite a few SBIR award winners from the Navy regarding the DCAA and the DCMA, it occurred to me that there could be a lot of small business government contractors...

A while back I wrote a blog about our Russ Farmer heading a joint committee of the SBTC and NDIA to take small business concerns to the DCAA and DCMA for resolution. At that time the committee was...

Last week we talked about some of the opportunities in the President's proposed new budget for FY2014. I would like to look at more of the specifics of how that might translate into something good for...

It seems that most of the news coming out of the Government lately is depressing and seems to not be in favor of small business contractors. Some of this bad news is political positioning and some of the...

The government released this week a draft for a Proposal (RFP) this week called One Acquisition Solution for Integrated Services (OASIS). OASIS is a Multiple Award, Indefinite Delivery, Indefinite...