DCAA Compliant Accounting System Requirements - Understanding the SF1408

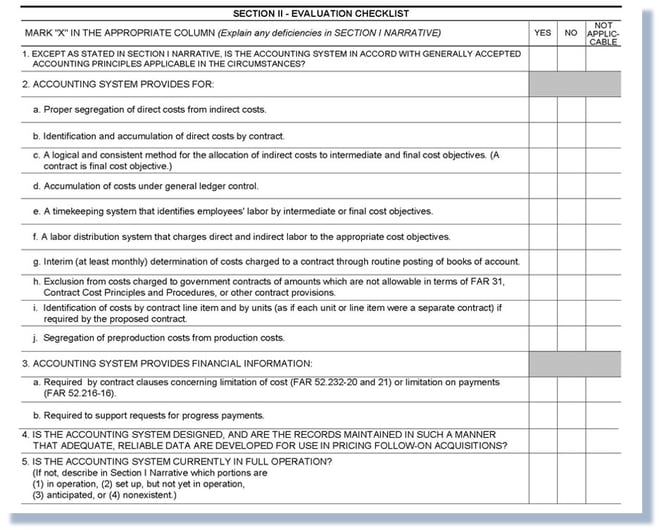

When a Small Business contracts with the Department of Defense, NASA, or the Department of Homeland Security (and potentially other agencies), they are often required to have a DCAA compliant accounting system. While there are many components of a compliant system (just as there many types of DCAA audits), the underlying procedure for assessing a contractor’s system is guided by the Standard Form (SF) 1408 (also known as the “Preaward Survey of Prospective Contractor Accounting System”), seen here below:

So, what does each requirement mean for your accounting system? Let's take a step by step look at each of the SF1408's requirements:

IMPORTANT NOTE: THE ENTIRE ACCOUNTING SYSTEM MUST BE CONTROLLED BY WRITTEN POLICIES AND PROCEDURES TO BE COMPLIANT. MOST, IF NOT ALL, OF THE REQUIREMENTS IN THE SF 1408 WILL NEED TO BE DOCUMENTED IN YOUR SPECIFIC POLICIES AND PROCEDURES.

Section 1 –“EXCEPT AS STATED IN SECTION I NARRATIVE, IS THE ACCOUNTING SYSTEM IN ACCORD WITH GENERALLY ACCEPTED ACCOUNTING PRINCIPLES APPLICABLE IN THE CIRCUMSTANCES?”

- Your accounting system must be in accordance with Generally Accepted Accounting Principles (GAAP). For instance, this means that all accounting will be recorded on an accrual basis (a cash-based accounting system will not meet these requirements).

Section 2 (a) – “(ACCOUNTING SYSTEM PROVIDES FOR): Proper segregation of direct costs from indirect costs.”

The accounting system must have separate accounts for each cost element in significant detail for audit. The direct costs must be collected and separated from indirect costs in the accounting system. The system should provide for invoicing direct costs to the government and properly allocating indirect costs for invoicing to the government (see 2(c)).

Section 2 (b) – “Identification and accumulation of direct costs by contract.”

- Contractors must maintain an adequate job costing system which is integrated with their accounting system. This means that costs must be accumulated by cost element and by project. For every direct cost transaction, a job or project number (or CLIN – see 2i below) must be assigned. Finally, a job cost ledger by project must be maintained by the contractor.

Section 2 (c) – “A logical and consistent method for the allocation of indirect costs to intermediate and final cost objectives (contracts).”

- Indirect costs must be grouped into logical categories (i.e. overhead, G&A, fringe, etc.) then allocated to every contract based on a defined methodology. Once defined, the government has specific guidelines, the methodology should be consistently applied.

Section 2 (d) – “Accumulation of costs under general ledger control.”

- The contract by contract accounting of direct and indirect costs being set up must be reconciled at least monthly with the Company's General Ledger.

Section 2 (e) – “A timekeeping system that identifies employees' labor by intermediate or final cost objectives.”

- Contractors must be able to provide labor distribution systems that shows labor allocated to projects and jobs based on the timekeeping system, as well as labor allocated to all indirect activities. This means the labor distribution system must provide labor hours and labor dollars by employee by job and indirect labor accounts. Government auditors rely on specific expectations for timekeeping techniques in order to reduce the risk of labor waste, fraud, and abuse.

Section 2 (f) - A labor distribution system that charges direct and indirect labor to the appropriate cost objectives.

- The source of this distribution must be the timekeeping system. Accordingly, the labor distribution must reconcile to the timekeeping hours, payroll system, job cost ledger and general ledger.

Section 2 (g) - Interim (at least monthly) determination of costs charged to a contract through routine posting of books of account.

- Costs must be accumulated and recorded at least monthly. Further, contractors must accumulate costs on a full cost absorption basis to show not only direct costs but indirect cost allocations as well. To meet this requirement, contractors must be able to present projects on a monthly basis showing full absorption costing, that is, showing total costs incurred on a given project including indirect cost allocations.

Section 2 (h) - Exclusion from costs charged to government contracts of amounts which are not allowable in terms of FAR 31, Contract Cost Principles and Procedures, or other contract provisions.

- Contractors must comply with the unallowable accounting requirements of FAR 31.201-6. This means the accounting system must track unallowable cost accounts in its accounting system. The system should be documented so that it is clear these costs will not be billed to the government.

Section 2 (i) - Identification of costs by contract line item and by units (as if each unit or line item were a separate contract) if required by the proposed contract.

- If required by contract terms, contractors may have to track costs by contract line item. This includes charging direct costs to line items and allocating indirect costs to contract line items.

Section 2 (j) - Segregation of pre-production costs from production costs.

Contractors must demonstrate the ability to account for/capture pre-contract costs separately. Pre-contract contract costs are any costs incurred before the effective date of a contract that were required to be incurred to meet schedule for some other contract requirement. In most cases, to be considered allowable, the cost must be subject to an advanced agreement with the government.

Section 3 (a) – “(ACCOUNTING SYSTEM PROVIDES FINANCIAL INFORMATION): Required by contract clauses concerning limitation of cost (FAR 52.232-20 and 21) or limitation on payments (FAR 52.216-16).”

- Contractors must establish policies that demonstrate compliance with the Limitation of Funds clause. This varies depending on the specifics of the contracts under execution by the contractor. However, in assuming a cost reimbursable environment, the contractor must demonstrate the ability to accumulate direct costs by project, allocation of indirect costs to projects and show current period, year to date and inception to date cost reports with comparisons to funding.

Section 3 (b) - Required to support requests for progress payments.

- Progress payments is a financing technique typically used to accommodate payments under large fixed-price contracts. The key feature of this financing method is contractors can bill up to 80% of contract costs (85% for small businesses) on a monthly basis. Since this is a cost-based billing method, an approved accounting system is required (see FAR 52.232-16).

Section 4 - IS THE ACCOUNTING SYSTEM DESIGNED, AND ARE THE RECORDS MAINTAINED IN SUCH A MANNER THAT ADEQUATE, RELIABLE DATA ARE DEVELOPED FOR USE IN PRICING FOLLOW-ON ACQUISITIONS?

- Meeting this last requirement is dependent on compliance with the requirements discussed above.

Section 5 - IS THE ACCOUNTING SYSTEM CURRENTLY IN FULL OPERATION? (If not, describe in Section I Narrative which portions are (1) in operation, (2) set up, but not yet in operation, (3) anticipated, or (4) nonexistent.)

- The accounting system does not have to be in operation at the time of a pre-award survey in order to receive a favorable rating. The DCAA Audit Manual suggests: “The audit scope should be limited to obtaining an understanding of the design of the prospective accounting system … It is not necessary to conduct an in-depth evaluation of the overall accounting system.” While it is preferred that a system is already set-up and operating at the time of audit, ReliAscent has passed pre-award surveys using demonstration data.

A nonexistent system will receive an unfavorable rating. By engaging ReliAscent at any time up to the day before the audit, you will join others who have passed their pre-award surveys.

Once your accounting system is brought into compliance, our team can then operate that system for you, on an outsourced, monthly basis, to ensure you maintain DCAA compliance, and do not run afoul of the Federal Government.

To learn more about our Government Contract Accounting, Business and Financial Consulting, and Contract & Grant Management Services for Small Business Federal Contractors and Grantees, contact ReliAscent today. Our team has a combined 200+ years of DCAA compliance and contract management experience, and is entirely unique in the Government Accounting Industry.

Don't know if you current accounting system is DCAA compliant? Click here to get your Free QuickBooks Compliance Review

Click Here to Download the White Paper Version of this Blog Post