To our Valued Clients and all Government Contractors & Grantees:

To our Valued Clients and all Government Contractors & Grantees:

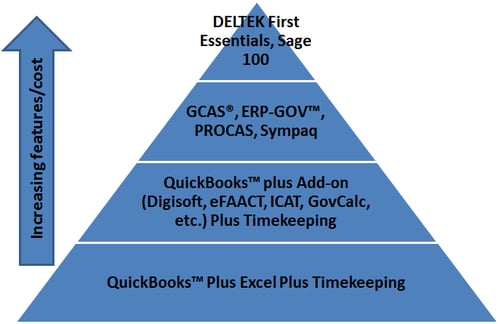

Many start-up businesses and small businesses are in need of a DCAA compliant accounting system but cannot afford many of the options for software that is DCAA compliant “out of the box”. These “out of...

I often hear people say they want to buy accounting software that is “DCAA Approved”. Or sometimes they say that they need an accounting system that is “DCAA Approved”. This is a bit of a misnomer. First...

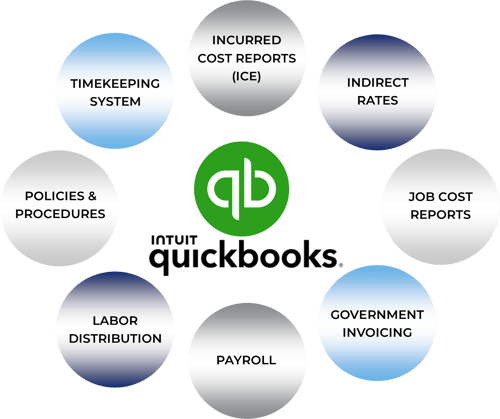

Many small businesses use QuickBooks® software for their accounting. QuickBooks® has been the number one selling accounting software for small business for many years. The reasons for this are many but...

Traditionally software was either designed to meet DCAA requirements or, if it was not, there were external engines required to make the system compliant for DCAA accounting. Most of the software...

The number one software for accounting for small business is usually considered to be the QuickBooks® program. This program is very flexible and very complete for setting up and operating a small...

Many small businesses are overwhelmed when they begin their first government contract. The ability to pass a DCAA audit for an accounting system is daunting....

Many people think that to be compliant with DCAA requirements you cannot use QuickBooks for your accounting system. While QuickBooks is not designed to meet the FAR and DCAA requirements (it is not a...